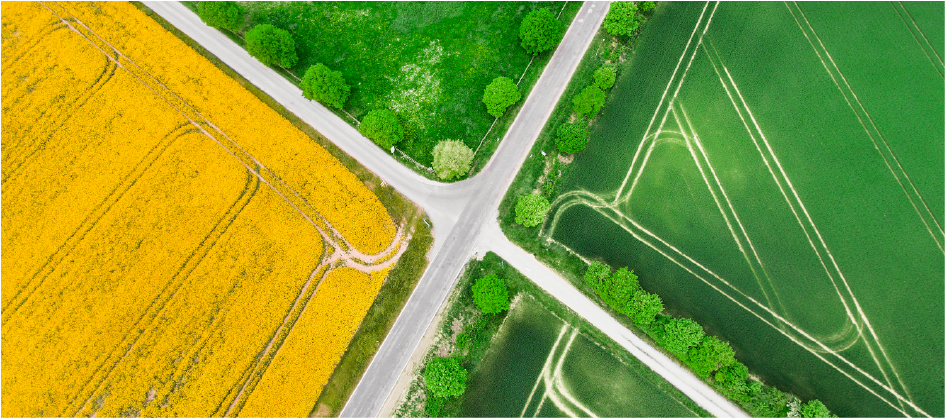

$44.6 billion in green investments

General Account Investments

By playing our part for a more sustainable future, we move closer to fulfilling our mission, manage long‑term risk for our shareholders and give our customers the confidence to plan toward the future.

General Account Investments

Green bond issuance amount is now more than $0.75 billion

Certified sustainable by third parties

90% of Manulife Investment Management’s Real Estate investment portfolio is certified to a green building standard

Looking for older reports? View our archives