The Journey Towards a Net Zero Future for Manulife’s General Account Investments

To accelerate a sustainable future, Manulife has implemented a bold Climate Action Plan: a global strategy to achieve net zero financed emissions by 2050, and reduce absolute operational scope 1 and 2 emissions 35% by 2035. The plan is focused in three key areas:

- Operations: substantially reducing emissions to lessen our footprint

- Investments: actively investing for a sustainable future

- Products and services: developing solutions that contribute to climate change mitigation

Making tangible progress on those goals takes the commitment of every business area across Manulife’s global operations. The General Account has risen to the challenge with a plan to achieve net zero financed emissions by 2050 which is no small feat.

Manulife’s General Account consists of the company’s own assets, which largely support policyholder liabilities and currently holds $427 billion worth of investments.

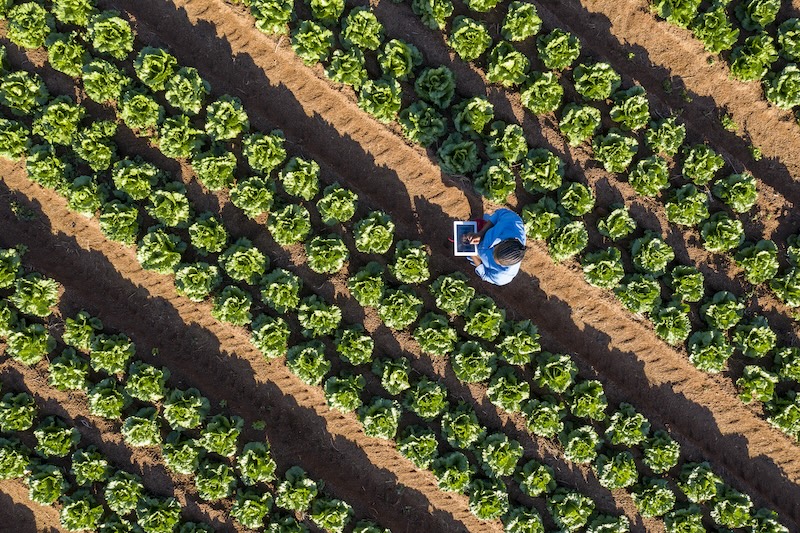

“The timeframe between selling a life insurance product to when a claim is made can be lengthy, sometimes decades apart,” said Adam Wise, Vice President, Natural Resources and Sustainable Solutions, at Manulife. “This requires a sophisticated asset liability management strategy that considers all material asset classes to achieve above market risk-adjusted returns while balancing the need to invest for a sustainable future. A long term, through-the-cycle, disciplined investment approach has historically allowed us to derive superior risk-adjusted returns by using a diversified, high quality asset mix – and we will be increasingly focused on supporting climate-positive areas of investment, including real assets like renewable energy, timberland and sustainable real estate.”

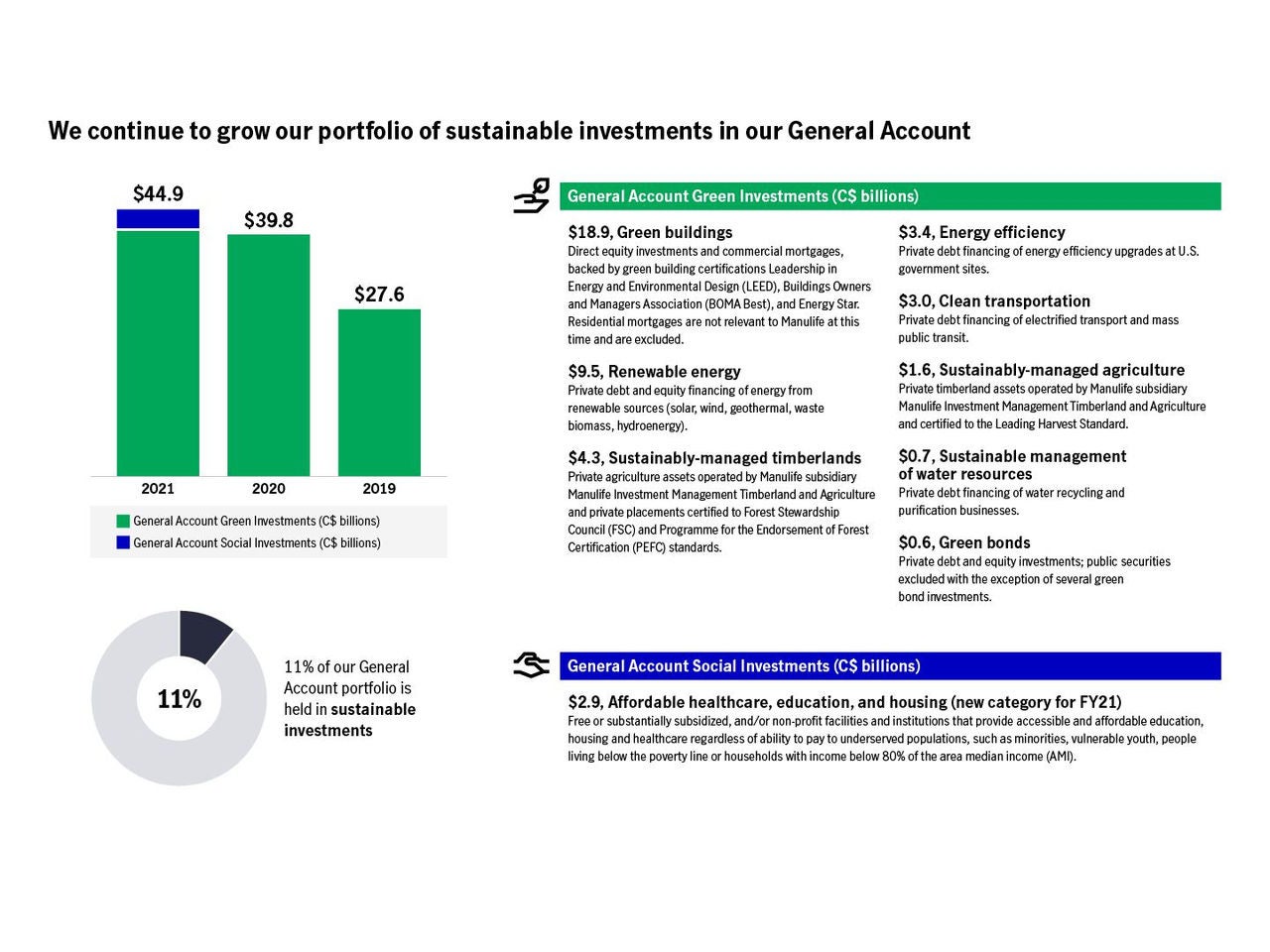

Currently, the General Account manages over $42 billion in green investments, a portfolio that continues to grow. Manulife’s existing green investments provide a substantial foundation to achieve its net zero financed emissions goal.

As a critical step to achieve net zero financed emissions, the General Account identified the carbon footprint of its portfolio and is using that data to set near-term science-based targets for carbon reduction that will set a clear path towards net zero by 2050.

To ensure these near-term targets have a meaningful impact, Manulife committed to the Science Based Targets initiative to guide the Company's target setting, measurement, and progress reporting. The Company is taking a sector-based approach to set near-term targets, focusing first on heavy emitting industries like power generation. Complementary to this work, the General Account uses a robust set of investment guidelines to manage environmental, social and governance (ESG) risks.

“We have multiple initiatives underway to reduce the ESG risks in our investments,” said Wise. “For example, we are actively focused on reducing exposures high-emitting areas of the portfolio and also shortening the duration of our holdings in certain sectors exposed to greater climate risks. To ensure we’re making data-informed decisions, we’ve partnered with our internal Advanced Analytics teams to generate insights, for example, to create an internal database to better track the decarbonization efforts of our borrowers and the associated impacts on our portfolio.”

To learn more about Manulife’s progress against its Impact Agenda objectives and focus on sustainability, visit Manulife.com/Sustainability